Table of Contents

For years you have been using credit cards to buy everything from gas to groceries. For all these years you were buying things online and you gave up any necessary information needed to buy those things. You never thought about a credit card scam, before handing it over to your local store’s cashier for the purpose of payment processing or while paying over the internet.

However, one fine night you came to know about credit card frauds, and thought ‘this can’t happen to me.”

No! you are wrong. credit card scams can happen to anyone at any point in time. And yes even if you are not a victim of a credit card scam yet, be prepared it could also happen to you.

Before the internet became mainstream, you might’ve thought or visualized a man dressed in black stealing your credit card. However, with the internet, nowadays scammers don’t even need your physical card to scam you.

Below are a few of the most common credit card frauds out there;

Think before Using Public Wi-Fi

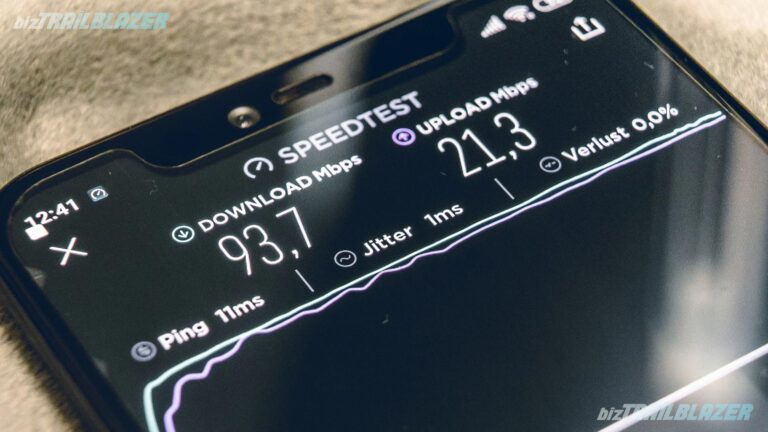

We always advise you to be careful while using any public Wi-Fi network. Frauds could monitor these public networks and sometimes, this network itself is a trap, that is laid by credit card scammers in order to get hold of your card’s information.

In this time of credit card scam, whenever your laptop or smartphone finds a public network and you connect to it. You might be asked to provide your credit card details in order to pay for your internet access. The network is often fake and a gateway for online credit card scams, in this case, you are giving away your credit card’s information directly to the scammers. In some cases, hotspots are free, but these scammers are always watching every move of yours, the password you enter is being recorded, whenever you are opening your bank account, they are also peeking into it.

So, while using any public Wi-Fi at a restaurant or hotel ask the staff for the correct name and password. Always avoid generic-sounding names like “Free Wi-Fi.” Also, try not to log into your bank account from any public Wi-Fi network. Also, you can use a VPN, which creates a secure connection even in public Wi-Fi hotspots.

Interest Reduction Scam

Interest reduction scam takes advantage of frustrated credit card users, who are looking to cut their credit card rates and to pay the remaining balances faster.

In this case, you’ll receive a pre-recorded call, where someone will offer you lower interest rates and an option to pay off your credit card balance sooner. All one has to do is pay a fee, enroll in a program, and the company will start working on lowering your interests. The call might even sound like it comes from your credit card issuer and even the scammers also might have your credit card details. At last, they will charge you for a service, which they never intended to provide you.

In order to avoid these kinds of credit card scams, register your phone number in the National Do Not Disturb database, which will lower the chances of getting calls from these numbers in the very first place. Also, in case of any calls like these, hang up the phone as soon as possible, more human interaction will lead to more calls. Also, keep in mind, if you are eligible for a lower interest rate, your card issuer will provide it for a much lower rate.

Credit Card Skimming

In this kind of credit card scam, the scammers will capture your credit card details while doing a legitimate transaction. Scammers often place a skimming device over a card processing terminal. Places like ATMs and gas stations are the favorite places for credit card scammers.

In order to avoid this credit card skimming, always inspect the credit card readers before using them. Specifically, inspect those placed in gas stations or in ATMs. Avoid using any credit card reader that looks like, it has been tampered with. Also try to cover your hand while entering your pin, as the credit card scammers often put cameras near a skimming device in order to capture the pin.

The Overcharge Scam

With more and more digital transactions, credit card scam is slowly growing its ground. Sometimes, you might receive a call stating your credit card has been overcharged in one of your recent transactions. How helpful! Isn’t it? But the problems might not be true.

The scammer will often address you by your name, and he/she might even provide the details of your daily transactions to become more convincing.

In case of receiving such calls, don’t ever give sensitive personal information over the phone. Hang up and check your credit card statement closely, in case of any suspicious activity, report it to the issuer.

Credit Card Scams in Hotels

You are relaxing on a beach, or you’ve just come from an important meeting while on a business trip and you suddenly got a call from the front desk. The call states, there’s a problem with the hotel’s computer system and the front desk needs your credit card details again. So, try not to provide any such details over the phone.

After receiving the call walk down to the front desk and ask about it. If that is not possible, call them right away and ask if they called to know your credit card details.

So, here are a few pointers for keeping your credit card and bank balances safe. Also, don’t expose your card longer than necessary, never lend your credit card to anyone, always check statements closely, and shred those credit card statements before discarding them. Also, while shopping online, shop from any secured site, just look for HTTPS:// (SSL Certificates / Secured Payment gateways) in the address bar and a lock on the right side of the address bar.

Lastly, never share your credit card details, CVV number, or any kind of one-time password over the phone. Just keep in mind, your credit card issuer won’t ask for these details. Most of the time these details are asked by the scammers. What if you have already been duped? Report credit card fraud to police immediately, also don’t forget to report credit card fraud to the bank and block the card in order to stop any further scams.

![BizTrailBlazer-Blog-APK-to-AAB---Google-To-Replace-APK-Format-From-August-[2021]](https://www.biztrailblazer.com/wp-content/uploads/2021/07/BizTrailBlazer-Blog-APK-to-AAB-Google-To-Replace-APK-Format-From-August-2021-768x432.jpg)

![[Step-by-Step Guide]: Car Battery Restoration At Home 26 BizTrailBlazer-Blog-Car-Battery-Restoration-At-Home-Safely-[Step-by-Step-Guide]](https://www.biztrailblazer.com/wp-content/uploads/2021/07/BizTrailBlazer-Blog-Car-Battery-Restoration-At-Home-Safely-Step-by-Step-Guide.jpg)

![Google To Replace APK With AAB From August, 2021 - A Full Story 27 BizTrailBlazer-Blog-APK-to-AAB---Google-To-Replace-APK-Format-From-August-[2021]](https://www.biztrailblazer.com/wp-content/uploads/2021/07/BizTrailBlazer-Blog-APK-to-AAB-Google-To-Replace-APK-Format-From-August-2021.jpg)

![Best Document Management Systems in 2021 [A Complete Guide] 28 Best-Document-Management-Systems-[A-Complete-Guide]---BizTrailblazer-Blog](https://www.biztrailblazer.com/wp-content/uploads/2021/07/Best-Document-Management-Systems-A-Complete-Guide-BizTrailblazer-Blog.jpg)

![Top 15 Best Chrome Extensions [in 2023]](https://www.biztrailblazer.com/wp-content/uploads/2021/07/BizTrailBlazer-Blog-Top-15-Best-Chrome-Extensions-in-2021.jpg)